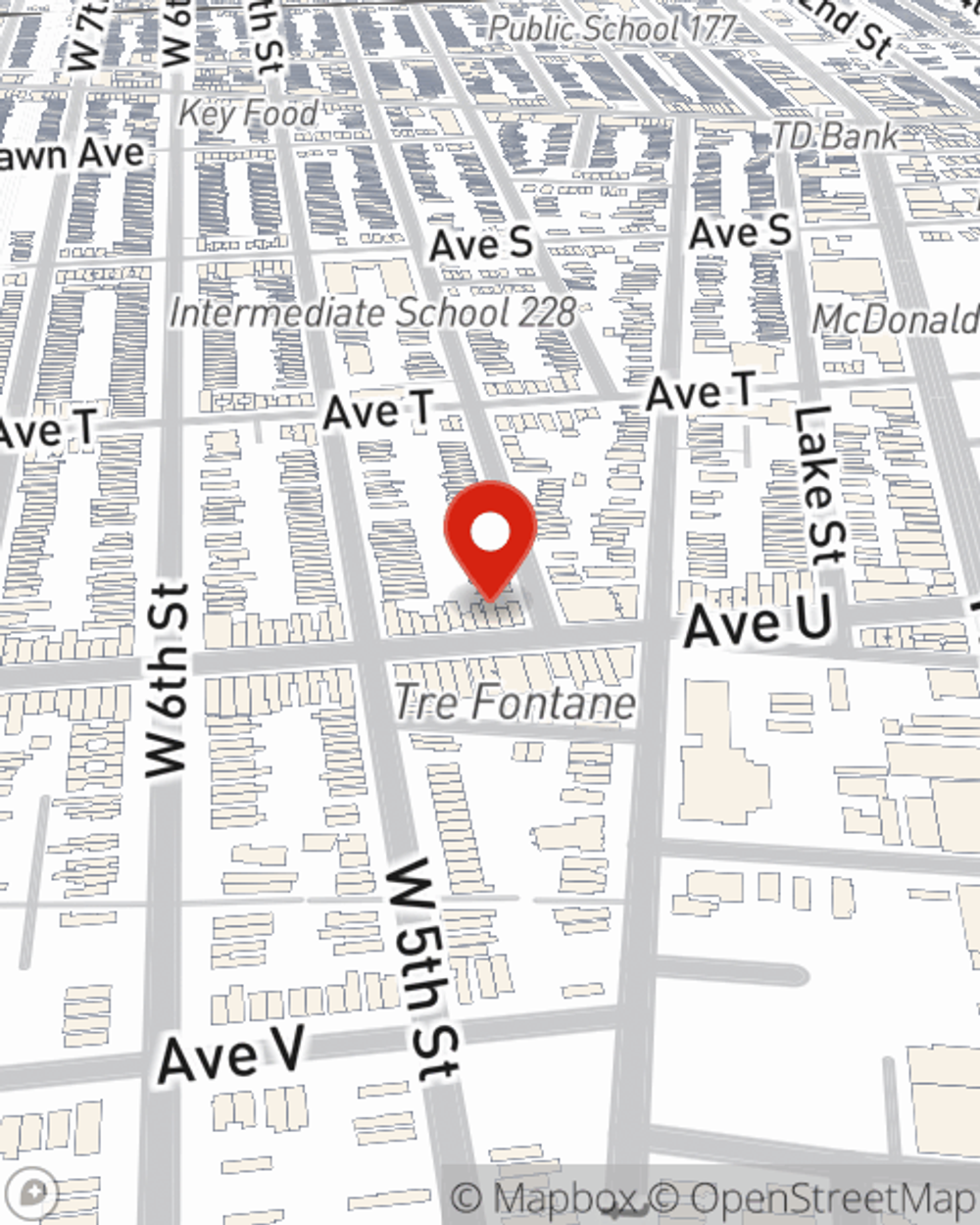

Business Insurance in and around Brooklyn

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

- Brooklyn

- Queens

- Staten Island

- Manhattan

- Bronx

- Nassau County

- Suffolk County

- Westchester County

- Rockland County

- Dutchess County

- Orange County

- Putnam County

- Ulster County

- Columbia County

- New York

- New Jersey

- Connecticut

- Pennsylvania

- Allentown

- Bucks County

- Lehigh County

- Monroe County

- Pike County

- Wayne County

Business Insurance At A Great Value!

Do you own a home improvement store, a music school or a sporting good store? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on making this adventure a success.

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

Your business thrives off your determination passion, and having reliable coverage with State Farm. While you do what you love and support your customers, let State Farm do their part in supporting you with commercial auto policies, business owners policies and worker’s compensation.

Since 1935, State Farm has helped small businesses manage risk. Reach out to agent Rob Perelmuter's team to discover the options specifically available to you!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Rob Perelmuter

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.